The costs of the energy system are connected indirectly with the income to the energy system through market mechanisms. Were the ‘money in’ attempts to stick to income to the system, and ‘money out’ attempts to stick to the final payments and costs to the system as a whole, this chapter attempts to trace the way that money moves around within the energy system – how costs are allocated from bills to suppliers, from suppliers to buy energy through the wholesale market, and how the final costs of the energy infrastructure is paid for from bills, by new connected consumers such as new houses, or by newly connected electricity generators or gas injectors. These transactions within the energy system are described below.

What domestic bills pay for

As discussed in the earlier section, money comes into the energy system in payment of bills. This money then gets distributed through the system – ultimately paying for the costs described in the cost structure.

A good starting point to illustrate this is domestic energy bills, as ofgem provides a breakdown of costs for electricity, gas and dual fuel (both combined) bills. These figures are derived from the statements made by each of the big six energy companies to Ofgem, as part of scrutiny on the business models and profits of the big six energy suppliers. You can find out more from these statements published by the companies, which cover both their supply and their generation incomes.

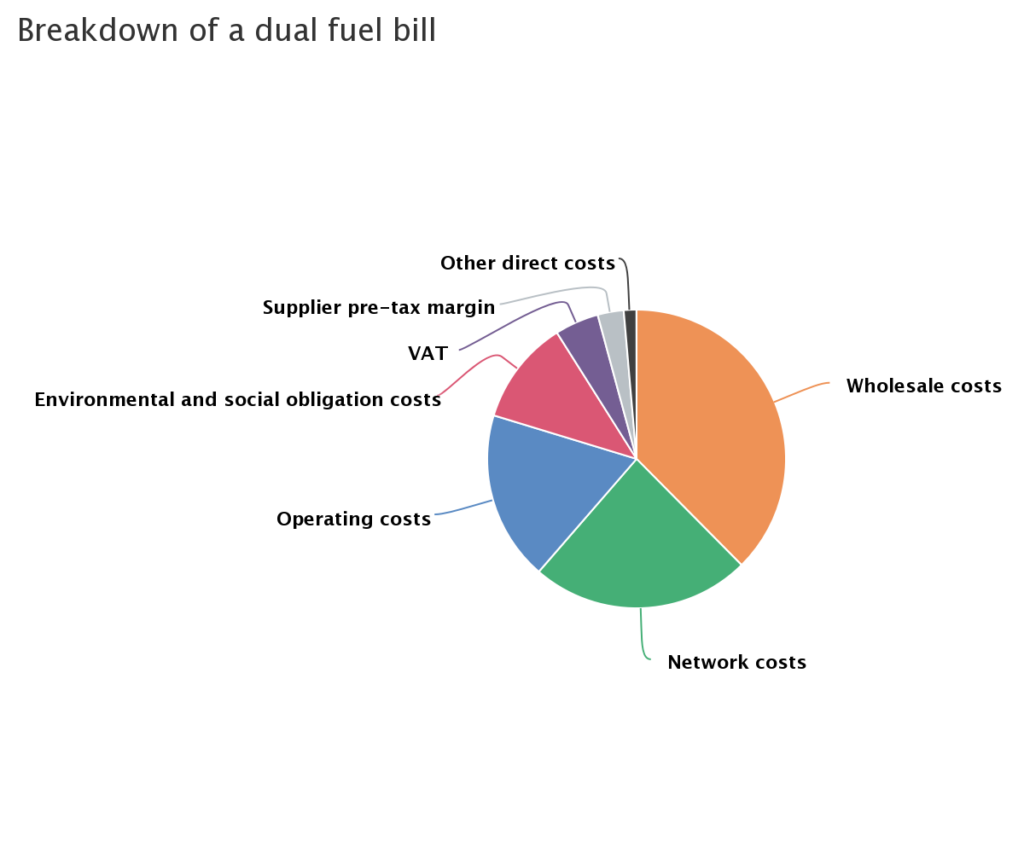

Breakdown of costs for a dual fuel (gas and electricity combined) bill

40% of the cost goes to wholesale purchase of the energy. 25% goes to pay for network costs. 20% goes to pay for the operational costs of the supply company – including billing, call centres, and metering costs. The rest goes to taxes as VAT, and to environmental and social obligation costs.

Environmental and social obligations

The environmental and social obligation costs redistribute funds within the energy system and pay for new investments, and can be seen as a way of taking into account externalities within energy system transactions. They are intended to make the system more socially valuable and environmentally sustainable in an economically efficient way. The financial cost implications can be evaluated differently depending on the timescale used, and who the costs and benefits are allocated to (are externalities taken into account

Environmental and Social Obligations are paid for by larger suppliers, based on the number of customers they have.

- Renewable Obligation

- Feed in Tariff

- Contract for Difference

- Warm Homes Discount – support to people at risk of fuel poverty (larger suppliers only)

- Energy Company Obligation – support with energy efficiency measures (larger suppliers only)

- Assistance for areas with high electricity distribution costs.

There has been a lot of media attention to complaining about the environmental and social obligations making bills more expensive. More careful analysis however shows that over a 10 year timescale these ‘costs’ could lead to bills being less expensive than they would otherwise have been. There are political questions involved in:

- Deciding that these costs should be taken from people’s electricity or gas bills, rather than from general taxation

- Allocating the costs between the electricity and the gas bill (the way this happens is in some ways counterintuitive)

- Framing these as extra costs rather than simply wrapping them into network and wholesale costs of long term investment.

Paying for necessary changes to the energy system from bills is ‘socially regressive’, as poor people pay a much larger proportion of their income for energy than rich people, whereas rich people are responsible for more carbon emissions. Using general taxation would be more progressive, as rich people pay more than poor people. This is discussed in detail by the Centre for Sustainable Energy in their study of distributional justice and UK climate change policy.

Electricity System transactions

Electricity Wholesale Market and Settlement

At the core of the internal workings of the energy system transactions is the wholesale market.

The electricity wholesale market in the UK, described in more detail in the next chapter on governance, is operated in half hour intervals in the UK (in many countries around the world this is 15 minutes rather than half an hour). This means that suppliers are responsible for balancing supply and demand in each half hour time period. They must purchase the same amount of electricity as they sell, in each half hour. As their consumers may use electricity at any time they want to without notifying the supplier in advance, this involves making predictions using statistical analysis. When suppliers are ‘out of balance’, i.e. the electricity they purchased does not match the electricity sold in a particular half hour, they must pay a penalty charge. This is administrated by the wholesale market operator, Elexon.

Currently, without smart meters, domestic electricity meters are read every six months, or even less frequently. There is no data on the amount of electricity consumed by a particular household in a particular half hour. In order to allocate the amount due to each supplier in each half hour, Elexon uses standard daily ‘profiles’ for each type of consumer, or ‘profile class’ that does not have a half hourly meter.

As meter readings come in over a period of several months, the calculation of exactly how much each supply company owes to whom, called the ‘settlement’ process, can be completed up to 14 months after a particular half-hour. It is for this reason that suppliers must ‘lodge credit’ with Elexon before they are allowed to trade, which causes a barrier to entry for smaller suppliers.

The wholesale market itself operates on a number of different timescales represented by different markets, including a day ahead market, and a futures market.

Although the electricity wholesale market operates half-hourly, electricity entering and leaving the grid must be physically balanced at every moment, as described in the physical infrastructure chapter. This is the responsibility of the Electricity System Operator (ESO), which in the UK is an arm of the private monopoly company National Grid.

This is achieved using a variety of financial payment mechanisms. In the UK market, one hour before each half-hour settlement period is a time called ‘gate closure’. At gate closure, supply companies state how much they expect to supply to their customers, and generators state how much they plan to generate. Generators also state how much they would charge to generate extra, or to generate less than planned. The ESO can then use this information to ask generators to meet any shortfall or reduce any excess generation during the half hour period.

Electricity balancing mechanisms

The ESO requires large generators to provide support with balancing, at a price set by the generator. This then affects the imbalance charges faced by suppliers that are out of balance. The SO also procures ‘balancing services’ through a variety of different mechanisms, which are listed on the national grid website. These balancing services payments provide an opportunity for income for providers of flexibility.

One of the big challenges with balancing and settlement is estimating how much electricity has been used by domestic customers in each settlement period. Large consumers of energy are typically metered on a half-hourly basis, but as discussed under flexibility [ref flexibility sub-section], traditional meters only measure cumulative electricity consumption, and make no record of the amount of electricity used in any particular half-hour. This means that assessing how much electricity a supplier sold to their domestic customers in a particular half-hour is a complex statistical process which can take up to 2 years, and involves a combination of the actual national electricity usage in that half-hour and the ‘demand profile’ of different customer-types, which are published by elexon and used for balancing and settlement purposes.

The barrier to entry to the supply industry is therefore increased, because a supplier has to lodge enough credit with the wholesale market operator, Elexon, to cover potential imbalance payments over a long period of time. The roll-out of smart meters has the potential to change this situation, as real-time data on the actual usage of electricity by each customer has the capability of being created. Whether and how this data will be used as part of the balancing and settlement process, and what this means in terms of privacy and data ownership, is still in discussion.

In some European countries e.g. Belgium and Spain, balancing is a separate function to retailing, which allows co-operative and community organisations to set up as licensed energy retailers, as the licensing requirements are less onerous. However, the balancing function in these countries is even more monopolistic than the GB supply industry.

Spatial and temporal variations in energy price

The possibility of renewable energy generators producing more electricity than can be used at any particular moment can lead to negative power prices – i.e. generators have to ‘dump’ the energy, or pay to put their electricity onto the system.

While the price of electricity varies through time depending on the balance of generation and consumption, it can also vary across space if there is congestion on the network and the electricity cannot be transported to where it is needed. This is brought to life by the map created by USA network operator MISO (Midwest Independent System Operator).

This shows how the price of electricity varied across the region (spanning several states in the American Midwest) at 9.25am on the 7th September 2011. This shows areas where there is a negative price of electricity, and areas where there is a high positive price. The negative price is in a location where there is a lot of wind generation, and low demand. There is a lack of interconnection to transport the electricity from areas of high generation to areas of high demand, leading to high and low prices in close geographic proximity to each other. More recent maps from this area show a much more uniform electricity price across the region, as the network operator has built new infrastructure to connect the wind generation to the centres of demand.

There’s more explanation of these maps on youtube.

Gas system

Gas Wholesale Market

The gas market is similar to the electricity market, in that it has to balance gas entering and exiting the network during each ‘settlement period’.

Some key differences to the electricity wholesale market:

- The settlement period for gas in GB is one day – the ‘gas day’ which is from 6am to the following 6am (or some similar 24 hour period), in contrast to a half-hourly settlement period in electricity.

- Between the entry to the network and the arrival at the customer’s premises, gas is owned by a ‘shipper’ rather than a supplier – although the supplier is often the same organisation. This is an additional role that does not have an equivalent in the GB electricity system – and is perhaps analogous to the countries where the balancing and the retail function are separated in electricity.

- It is possible to physically store gas, and shippers do this as part of their balancing process, whereas storage in electricity is a separate role that is lumped together with generation rather than supply.

- Shippers are responsible for buying space within the gas network to ship the gas. This is in kWh per day.

New business models

Heat network bills

As discussed under ‘heat networks’ in the ‘money in’ section, there are specific challenges with heat networks as local natural monopolies. This makes heat networks a particularly important context for alternative business models, which can provide consumer protection through direct accountability as an alternative to market competition.

Energy as a service

One approach to making energy affordable while incentivising efficiency is to sell ‘energy as a service’ rather than ‘energy as a commodity’. That means that companies selling energy are trying to provide the best experience (of warmth, of light in a home etc), for the least cost, rather than sell lots of units of energy.

Energy Performance Contract

A popular business model for providing energy as a service is the ‘energy performance contract’, where a provider guarantees a certain level of comfort and light, but takes on replacing light bulbs, draught proofing the building fabric etc as well as buying the energy itself.

This type of contract usually involves an assessment of what is possible, and the current annual cost of energy. The contractor would then take on the energy bills, and charge an annual fee to the client which is lower than their current/historic bills. The contractor then implements energy efficiency measures, which reduces the cost of buying energy even further. For an agreed period of time, the contractor and charges an annual bill that is between the historic energy bill and the new cost of buying energy, and uses this money to repay the cost of the energy efficiency measures. At the end of the contract, the customer becomes responsible for paying now permanently reduced bills. The energy service contract may also include getting a good deal for buying energy.

This process is shown in the diagram below:

In practice, in the context of a low unit price of energy only a limited range of energy efficiency measures are varible under this form of contract. Additionally, some of the savings may rely on the energy user’s behaviour and choices. Energy performance contracts do exist in the commercial sector, but tend to focus on ‘low hanging fruit’ such as LED lighting.

Municipally owned energy company Bristol Energy has been exploring options for heat as a service as part of an Energy Systems Catapult ‘living laboratory’ project of households upgraded to a ‘smart super home’ level. This is currently a trial, rather than a commercially available service.

Energy Efficiency

Energy efficiency, rather than renewable energy generation, is talked about as a theoretical priority for many community energy groups. However, in the context of the Feed in Tariff for renewable electricity generation, this has proved to be much more difficult to put into practice. The challenge is twofold:

- The technical complexity of deep retrofit of homes to a high standard is beyond the capacity of most community energy groups

- The business model for energy efficiency does not allow financial viability in a straightforward way. It either needs some form of grant or subsidy, or needs householders to pay due to climate-change or other motivations, not for pure financial payback.

Carbon Co-op, based in Manchester, do a really good job. They have a close partnership with architects who have a very high level of relevant technical skill, and most of their big projects have at least been partially grant-funded.

BEIS are currently funding a number of pilot projects to develop the market for ‘able to pay, owner-occupied’ retrofit. These include People Powered Retrofit by Carbon Co-op in Manchester, and FutureProof by Centre for Sustainable Energy in Bristol.

Lessons for energy democracy

- Discount rates and NPV – look at these critically, especially in the context of climate change

- Cost-reflectivity principle limits policies such as rising block tariff, which could enable affordability for all and incentivise energy efficiency/demand reduction.

- Utilisation rate of peaking plant and network infrastructure is going down, with implicatiosn for the balance of fixed and variable costs of the energy system.

- Low unit price may seem good for fuel poverty and a popular policy, but makes viability of energy efficiency really difficult, including Energy performance contracts which could be a key part of energy as a service business models.